In the dynamic world of cryptocurrency, one strategy that seasoned investors often explore is 'shorting', a speculative approach that profits from a decline in a cryptocurrency's value. This complex process, which includes understanding the fundamentals of short-selling, choosing an appropriate trading platform, conducting thorough market analysis, executing short positions, and effectively managing risk, requires a solid grasp of the cryptocurrency ecosystem.

As we unravel the step-by-step guide to shorting crypto, you will discover the nuances of these steps and why each one is vital in this high-stakes financial maneuver.

Key Takeaways

- Understanding the basics of crypto shorting is crucial, including its methods, risks, and profit potential.

- Choosing the right trading platform is imperative, considering factors like security, fees, and short-selling capabilities.

- Analyzing market trends and using technical tools can guide profitable shorting decisions.

- Managing risks through strategies like stop-loss orders and regular market analysis can limit losses and heighten profit chances.

Understanding Crypto Shorting Basics

In the realm of cryptocurrency trading, understanding the fundamentals of shorting—a practice that involves betting on a cryptocurrency's price decline by borrowing and selling it at current market prices—is paramount for strategic investment.

Shorting, an advanced trading strategy, allows a trader to profit from a market downturn, assuming they can accurately predict such a decline. The process involves borrowing a cryptocurrency and selling it at its current price, with the intention of buying it back at a lower price. The difference between the selling price and the repurchasing price represents the short seller's profit.

Various methods of shorting exist in the cryptocurrency market, including futures trading and margin trading. Each method carries its own set of risks and requires a comprehensive understanding of market dynamics. Shorting is associated with high risk as potential losses can exceed the initial investment if market conditions aren't accurately predicted. Consequently, risk management strategies are essential to mitigate potential losses.

A trader's ability to hold a profitable short position is contingent on their understanding of market conditions, their risk tolerance, and their ability to make precise price predictions.

Selecting the Right Trading Platform

After comprehending the fundamentals of shorting, the next critical step is to select an optimal trading platform that meets your specific short-selling needs and preferences. A good platform should have a proven track record in handling short-selling transactions and offer a variety of methods like margin trading, futures trading, and binary options.

When selecting the right trading platform, consider its liquidity, security features, and customer support. Higher liquidity ensures smoother transactions, while robust security features protect your investments. Prompt and efficient customer support can be invaluable, should you encounter any issues.

Also, evaluate the platform's fees and leverage options. Lower fees can maximize your profits, while flexible leverage options enable you to short-sell more effectively. A user-friendly interface and the availability of educational resources are also beneficial.

Consider the following in a trading platform:

| Criteria | Importance | Examples |

|---|---|---|

| Short-Selling Methods | Variety of options for flexibility | Margin Trading, Futures Trading, Binary Options |

| Platform Features | Ensures successful transactions | Liquidity, Security Features, Customer Support |

| Cost and Leverage | Impacts profitability | Fees, Leverage Options |

Analyzing Market Trends

To successfully short cryptocurrencies, meticulous analysis of market trends is essential. This involves studying historical data, price patterns, and trading volumes. A crucial step in this process is to have a comprehensive understanding of key indicators used in technical analysis such as moving averages, RSI, and MACD. These indicators provide insights into potential entry and exit points for shorting.

Furthermore, it is essential to grasp the market sentiment, which can be assessed through social media trends, news sources, and sentiment analysis tools. These tools can provide a nuanced understanding of trader psychology, which often drives market trends.

It's also important to note the following:

- Utilizing technical analysis tools like Fibonacci retracements, support and resistance levels, and chart patterns can aid in identifying trends and market reversals.

- Regular monitoring of market news and regulatory announcements can offer insights into potential macroeconomic factors affecting the crypto market.

- Historical data offers invaluable insights into how a particular cryptocurrency has performed under different market conditions.

- Understanding price patterns and trading volumes can indicate potential price movements, providing an opportunity for profitable shorting.

In essence, effective shorting of cryptocurrencies requires a comprehensive and informed analysis of market trends.

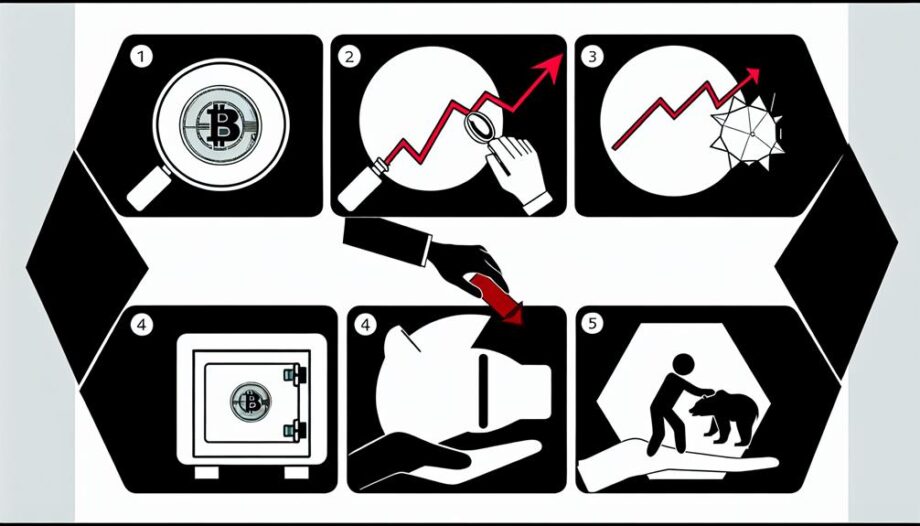

Executing Your Short Positions

Executing short positions in the realm of cryptocurrency necessitates strategic planning and meticulous attention to detail, starting with the establishment of a trading account on a platform that supports short selling. The primary action is to identify the cryptocurrency to short and determine the amount to sell on the trading platform. Simultaneously, it is vital to set up a stop-loss order, a step that helps limit potential losses if price movements go against your short position.

Monitoring the market is a crucial activity in short selling. Keeping a keen eye on price movements, market trends, and overall market sentiment can inform the decision on when to close your position.

Lastly, realizing a profit requires buying back the cryptocurrency at a lower price. This action is the essence of short selling, where the profit is the difference between the initial selling price and the buy-back price.

| Steps | Description | Keywords |

|---|---|---|

| 1. | Set up trading account | trading platform, short selling |

| 2. | Identify cryptocurrency and sell amount | cryptocurrency |

| 3. | Set up stop-loss order | stop-loss order |

| 4. | Monitor the market | monitor market, price movements |

| 5. | Buy back at a lower price to close position | buy back, lower price, close position, realize profit |

Managing Risks in Shorting

Navigating the high-risk waters of shorting cryptocurrency necessitates a deep understanding of market dynamics, effective risk management strategies, and, often, guidance from financial experts. The volatile market conditions can drastically affect your profits and losses. Therefore, managing risks is a critical component of shorting crypto.

Several approaches can assist you in mitigating risks and maximizing potential profits:

- Understanding Market Dynamics: Analyze the prevailing market trends and indicators. This aids in making informed price predictions.

- Risk Management: Implement strategies to prevent losses exceeding your initial investment. Stop-loss orders can be a useful tool in this regard.

- Market Analysis: Regularly perform technical and fundamental analysis. This will provide insights into potential market shifts.

- Consulting Financial Experts: Seek advice from professionals experienced in shorting crypto. They can provide valuable perspectives and strategies.

In essence, the high risk associated with shorting crypto can be managed effectively with an understanding of market dynamics, comprehensive risk management, accurate market analysis, and expert guidance. This approach can increase your chances of making profits in a volatile market while simultaneously limiting potential losses.

Frequently Asked Questions

How Do You Short in Crypto?

Shorting crypto involves understanding shorting basics like borrowing mechanism and margin trading. It necessitates careful risk management due to loss implications, short squeeze, market volatility, and liquidation threats. It offers significant profit potential if executed properly.

How to Do Short-Term Crypto?

To execute short-term crypto trading, one must closely monitor crypto volatility, utilize smart investment strategies, conduct thorough market analysis, choose reliable trading platforms, and manage risks while considering regulatory and tax implications.

How to Do Cryptocurrency Step by Step?

To understand cryptocurrency step by step, one must learn blockchain basics, secure crypto wallets, mining cryptocurrencies, and execute secure transactions. Knowledge of decentralized finance, Initial Coin Offering, crypto taxation, stablecoins, digital assets, and crypto regulations is also crucial.

What Is the Easiest Exchange to Short Crypto?

Binance, with its user-friendly interface, robust risk management features, extensive margin trading options, and efficient liquidation process, is considered the simplest exchange for shorting cryptocurrencies amidst market volatility.

Conclusion

In conclusion, shorting crypto necessitates a comprehensive understanding of the market dynamics, the right trading platform, and effective risk management strategies. The inherent volatility of the cryptocurrency market and regulatory uncertainties underscore the importance of these steps.

Therefore, individuals should seek expert advice and remain vigilant about market trends before engaging in crypto shorting. Ultimately, successful shorting in the crypto market is a combination of knowledge, strategic execution, and constant vigilance.